India’s GCC Advantage Expands West: The Emerging Saudi-UAE Extension Model

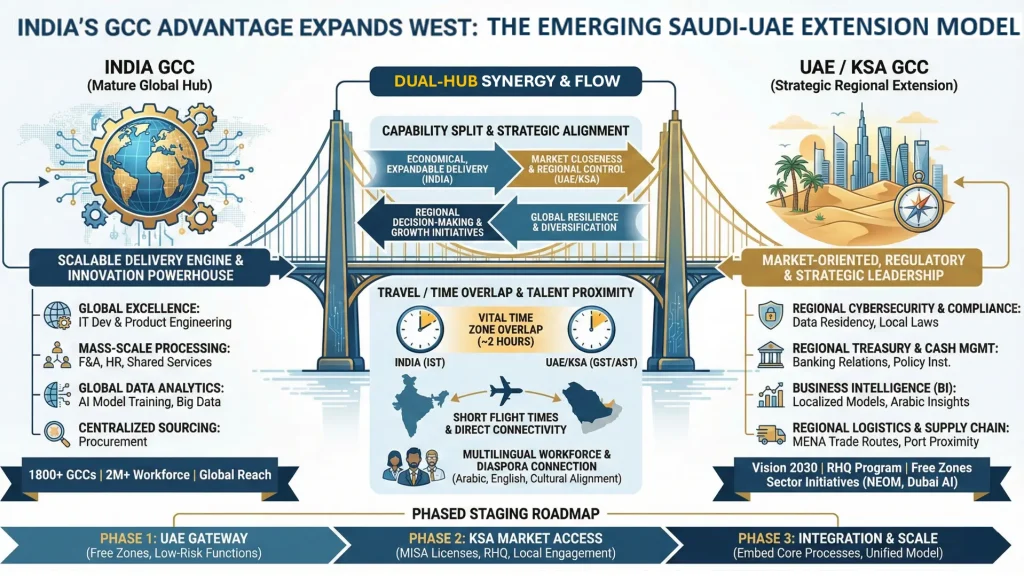

The ecosystem of Indian GCCs has transitioned from a cost arbitrage model to an innovation powerhouse. With 1800+ GCCs and 2M+ workforce, India has secured its position as the global hub for technology, finance, and engineering capabilities. As these centers mature, their essential priorities are to transition from mere scale to global resilience, market closeness, and diversification. This evolution is now driving the next wave of expansion, positioning the UAE and Kingdom of Saudi Arabia (KSA) not as alternative GCC locations, but as critical, complementary extensions of the established Indian centers.

This expansion into the Gulf Cooperation Council (GCC) area is a calculated plan to take advantage of the remarkable economic changes occurring in KSA and the UAE, particularly through Vision 2030 and comparable national initiatives. For MNCs, establishing a presence in these markets via an extended GCC model is no longer a choice, it is a necessity for capturing regional growth and ensuring business continuity.

Incentives and Policy Dynamics

The main catalyst for this alignment is the strongly motivated regulatory and investment landscape promoted by the governments of the UAE and KSA. Both countries are actively seeking economic diversification, transitioning from reliance on hydrocarbons to sectors such as knowledge-based industries, technology, logistics, and finance.

Programs and Pipelines

The policy structures in the UAE and Saudi Arabia are intentionally crafted to draw high-value, digital-first GCC operations, establishing the area as a link between international companies and local markets

- Saudi Vision 2030 and the Regional Headquarters (RHQ) Initiative: In line with its extensive transformation plans, Saudi Arabia seeks to establish itself as a worldwide centre for investment, innovation, and logistics. At the core of this is the RHQ Program, which encourages MNCs to set up their regional leadership teams in Riyadh by offering tax advantages, prioritized access to government contracts, and prolonged operational stability. This signifies a transition for GCCs from conventional back-office roles to strategic functions that manage regional decision-making and growth initiatives while owning P&L.

- UAE’s Entrepreneurial-Friendly Environment: The UAE, especially Dubai and Abu Dhabi, remains the commercial hub of the Middle East. Free zones like Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) provide 0% corporate tax on eligible income, full foreign ownership, and a strong common-law legal system. These areas are perfect for setting up high-compliance, knowledge-driven GCC functions like FinTech, Legal, and Treasury operations that require regulatory authority and global standards.

- Initiatives and Infrastructure Specific to Sectors: Major initiatives like NEOM in Saudi Arabia and Dubai’s AI Strategy offer both infrastructure preparedness and policy-oriented backing for GCCs in areas like intelligent logistics, construction technology, and enterprise AI. These efforts create long-term contract opportunities and specialized technology areas that reduce entry risks and speed up growth.

These policy environments facilitate a dual-hub operational framework allowing India to serve as the economical, expandable delivery center, while the Middle East contains market-oriented, regulatory, and strategic leadership roles. This provides businesses a smooth combination of efficiency and closeness, guaranteeing they can expand globally while catering to local needs.

Talent and Proximity Benefits

The case for expansion into the Middle East is equally compelling from a talent and operational standpoint, driven by proximity, cultural alignment, and access to specialized capabilities. The region complements India’s GCC ecosystem by adding agility and contextual expertise while maintaining scalability.

Complementary Roles Across Hubs

India’s GCCs have established global excellence in IT development, financial shared services (F&A), and R&D. The Middle East extension, however, adds unique regional advantages, most notably, a time-zone overlap, multi-lingual workforce, and direct proximity to key regulatory and financial centres.

India GCC (Hub) | UAE / KSA GCC (Extension) | Strategic Rationale |

Global IT Development & Product Engineering | Regional Cybersecurity & Compliance | Ensures adherence to local data residency laws and regulatory body engagement. |

Mass-Scale Transaction Processing (F&A, HR) | Regional Treasury & Cash Management | Facilitates direct coordination with Middle Eastern banks and policy institutions. |

Global Data Analytics & AI Model Training | Business Intelligence (BI) for Regional Sales & Marketing | Localizes global models for regional markets, including Arabic and cultural insights. |

Centralized Procurement & Sourcing | Regional Logistics & Supply Chain Planning | Utilizes proximity to ports, customs, and real-time MENA trade routes for a faster turnaround. |

The two-hour difference in time zones between India and the Gulf countries produces a vital overlap period, which improves collaboration and minimizing delays in the comparison to operations across continents. Additionally, the substantial and well-trained Indian diaspora in the UAE and KSA creates an instant cultural and linguistic connection, facilitating the transition and assimilation of extended GCC operations. Ultimately, the region’s workforce of Arabic-speaking professionals meets the essential requirements of customer service, legal and compliance roles, where effective communication and regulatory understanding are essential.

Compliance Notes and Staging

While the strategic rationale for expansion is strong, success ultimately hinges on meticulous compliance management and a well-orchestrated staging roadmap. Establishing operations in KSA and the UAE requires careful alignment with local labor, data, and tax regulations, all while maintaining organizational agility and governance standards.

- Local Content and Labor Laws: One of the most critical compliance considerations is nationalization specifically Saudization in KSA and Emiratisation in the UAE. These frameworks mandate that a certain percentage of the workforce be composed of local citizens. Forward-looking GCCs view this not as a compliance hurdle but as a strategic opportunity by investing in training, mentorship, and integration programs that cultivate skilled national talent for high-value digital and analytical roles.

- Data Residency and Sovereignty: As GCC extensions assume greater responsibility in finance, cybersecurity, and regulatory functions, strict adherence to local data protection laws becomes non-negotiable. Organizations must ensure that regional customer and transaction data is stored and processed within designated geographic boundaries often through dedicated, ring-fenced cloud infrastructure or on-premises data centers distinct from the central India hub.

- Transfer Pricing (TP) Documentation: With operational functions distributed between India and the Middle East, robust Transfer Pricing documentation is essential. Inter-company pricing for shared services such as India’s IT support for the UAE’s Treasury operations must follow the arm’s length principle, ensuring compliance with tax authorities in both jurisdictions and minimizing regulatory risk.

A phased staging approach is highly recommended:

- Phase 1 – UAE Gateway: Establish an initial legal entity typically within a Free Zone to launch low-risk, high-visibility functions such as Treasury, Regional Sales, and Strategic Leadership. This phase benefits from the UAE’s predictable regulatory landscape and global connectivity.

- Phase 2 – KSA Market Access: Obtain the necessary Ministry of Investment of Saudi Arabia (MISA) licenses to operate in Saudi Arabia, beginning with a Branch Office or Regional Headquarters (RHQ) structure. This enables direct engagement with local clients, aligns with Vision 2030 mandates, and positions the organization for government-linked opportunities.

- Phase 3 – Integration & Scale: Embed the India GCC’s core delivery processes into the Middle East hubs, ensuring technological, cultural, and operational integration. This creates a unified, two-part capability model India as the scalable engine, and UAE/KSA as the regional control and strategy center.

By treating UAE and KSA as complementary commercial and policy amplifiers for their established Indian operations, MNCs can develop a resilient, regionally rooted, and globally connected operating model ready to capture the accelerating growth across the Middle East.