Why Companies Chose India for Their GCCs in 2025

The global corporate landscape underwent a massive transformation in 2025. While Global Capability Centers (GCCs) once served primarily as back-office support functions for Western headquarters, they have now evolved into the nerve centers of global innovation. India stands at the heart of this evolution. As enterprises look toward 2026, the narrative has shifted from operational support to the creation of intelligent ecosystems that drive the future of the modern firm.

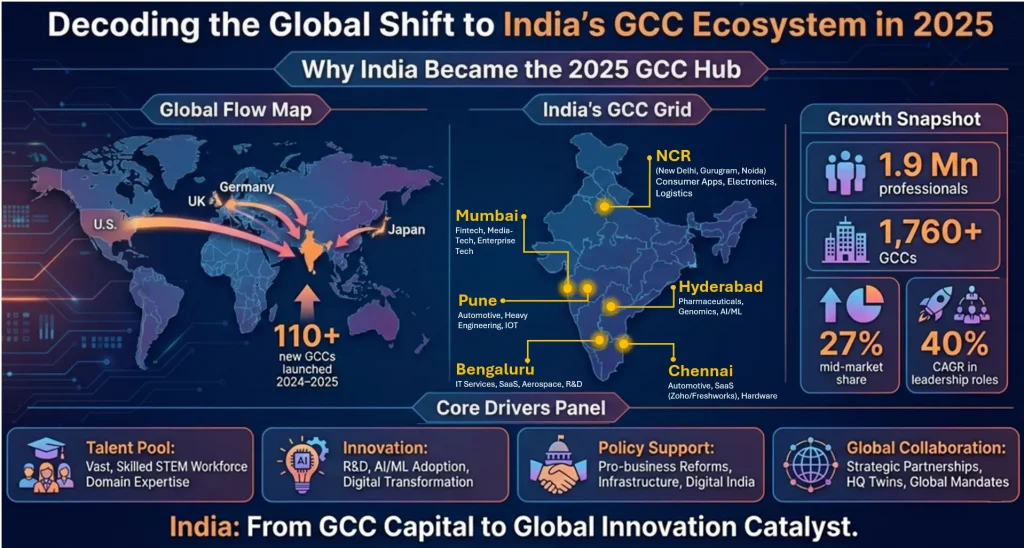

The Global Shift Toward India’s GCCs

The year 2025 marked a definitive turning point in how multi-national corporations view their Indian operations. The traditional model focused on labor arbitrage is fading, replaced by a strategic necessity to be where the world’s most advanced digital work happens.

From Cost Advantage to Capability-driven Expansion

In previous decades, companies established GCCs in India to reduce overhead. Today, the primary driver is value creation. Organizations no longer move processes to India just to save money, they do so to gain access to world-class engineering excellence and specialized innovation. These centers now own complex product life cycles, manage global cybersecurity protocols, and lead research and development (R&D) initiatives. By focusing on capability rather than cost, enterprises ensure that their Indian hubs contribute directly to the global bottom line through high-impact intellectual property and process optimization.

The Mid-market Momentum and Mega GCC Scale

The GCC landscape in 2025 saw a fascinating dual trend. On one hand, lean mid-market companies accelerated their transformation by setting up agile centers that focused on niche technology stacks. These smaller, specialized units often outpaced larger competitors in deploying Gen-Artificial Intelligence (AI) and automation. On the other hand, established Mega GCCs, those employing thousands of professionals matured into global strategy hubs. These massive entities now host global leaders and departmental heads who manage international portfolios directly from India, proving that scale and sophistication go together.

The 5 Factors Behind India’s GCC Leadership

Several distinct pillars supported India’s dominance as the preferred destination for GCCs throughout 2025. These factors created a competitive advantage that few other geographies could replicate.

Deep and Diverse Talent Pool

India’s greatest asset remains its human capital. With over 2.1 million professionals currently powering digital and product innovation, the country offers a talent density that is unmatched globally. This workforce is no longer just proficient in legacy systems and skills, it leads the world in emerging domains like cloud computing, data science, and full-stack engineering. This massive pool allows companies to scale their teams rapidly without compromising on the quality of technical expertise.

Government-backed Ecosystem

State and central governments in India have moved from being regulators to facilitators. Progressive policies, such as the Telangana AI Mission (T-AIM), have created fertile ground for advanced technology adoption. Programs like ‘Beyond Bengaluru’ encourage companies to explore emerging hubs, offering incentives for infrastructure development and digital growth. This proactive governance reduces the friction for foreign firms looking to establish a long-term presence in the country.

City-led Innovation Clusters

India has developed a robust innovation grid centered around six key cities: Bengaluru, Hyderabad, the National Capital Region (NCR), Pune, Chennai, and Mumbai. Each city offers a unique micro-ecosystem. While Bengaluru remains the undisputed tech capital, Hyderabad has emerged as a leader in life sciences and AI. Meanwhile, Pune and Chennai dominate the automotive and manufacturing engineering sectors. This geographic diversity allows companies to choose a location that specifically aligns with their industry needs.

Rise in Leadership and Global Mandates

One of the most significant shifts in 2025 was the surge in high-level leadership roles within Indian GCCs. The ecosystem recorded a 40% compound annual growth rate (CAGR) in leadership positions. Indian leaders now hold end-to-end ownership of global portfolios, making critical decisions that affect the entire organization. This shift from execution to ownership means that Indian centers now dictate global strategy rather than just following instructions from a distant headquarters.

Expansion Beyond the US Corridor

While American firms historically dominated the Indian GCC market, 2025 saw a wave of new entrants from the United Kingdom, Germany, Denmark, and Japan. This diversification reduces the ecosystem’s reliance on a single economy and brings a variety of work cultures and engineering philosophies to the region. European automotive giants and Japanese financial institutions are now competing for the same top-tier talent, further validating India’s status as a global talent magnet.

India’s GCCs: From Capital to Global Catalyst

The maturity of the GCC model has turned India into a catalyst for global enterprise change. These centers no longer just support the business they are the business.

The Next Decade of Enterprise Innovation

The matured GCC ecosystem will redefine how global companies operate through 2030. By leveraging India’s talent and infrastructure, enterprises achieve a level of agility that was previously impossible. These centers act as innovation engines that test new products, automate back-end workflows, and provide 24/7 technical resilience.

Lack of access to skilled talent and extended hiring timelines are often the biggest challenges faced by enterprises as they scale their GCCs. However, India’s integrated ecosystem of universities, startups, and established tech firms provides a steady pipeline that mitigates these risks. As enterprises look toward 2026 and beyond, the Indian GCC will continue to transition from a supporting role to a leading role, driving the next wave of global efficiency and intelligent growth. Any organization aiming for a future-ready digital strategy must view India not just as a location, but as a strategic partner in innovation.