Which Business Capabilities Belong in a GCC vs Stay at HQ?

The architecture of the modern multinational is no longer hierarchical, it is increasingly a distributed brain, with intelligence and execution spread across geographies. As Global Capability Centers (GCCs) mature, the conversation has moved beyond whether global talent should be leveraged to a more strategic question:

Where should different enterprise capabilities live?

The allocation of capabilities between headquarters and the GCC is not static and shifts in line with the organization’s evolving strategic priorities. It is shaped by the original intent behind establishing the GCC, the enterprise’s long-term growth ambitions, and its transformation agenda. As business models, technologies, and market conditions shift, this capability allocation must be continuously reassessed.

The HQ–GCC dynamic is often framed as a battle for ownership, but resilient organizations see it as a strategic orchestration challenge. Misplaced capabilities can erode brand identity or stifle scale and innovation. Defining the boundary between global and local responsibilities is now a foundational leadership decision, shaping cost structures, innovation velocity, and corporate identity.

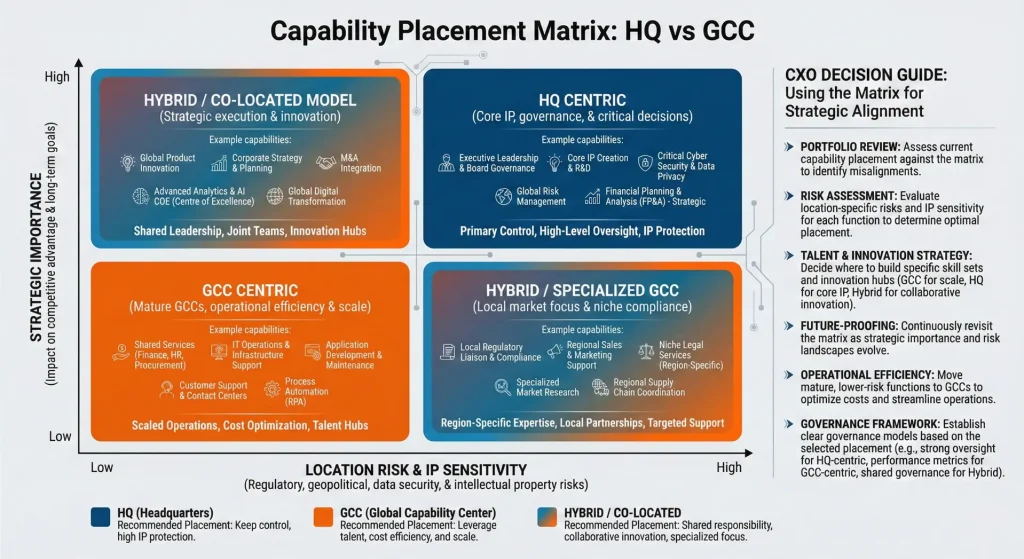

Framework for Allocating Capabilities Across HQ and GCC

Determining where a capability should reside requires more than a cost-based decision. Leaders must assess functions through the lens of strategic importance, competitive advantage, and enterprise risk. The goal is not simply to move work to the lowest-cost location, but to place capabilities where they can create the greatest value with the least friction.

Three-Tier Capability Classification

A robust allocation framework groups enterprise functions into three tiers:

- Enabling Capabilities: These are foundational, standardized functions such as IT infrastructure, HR operations, payroll, and finance processing. They are essential but not differentiating, making them strong candidates for Global Capability Centers (GCCs), where scale, process excellence, and automation can drive efficiency.

- Differentiating Capabilities: These functions create competitive advantage advanced analytics, supply chain optimization, engineering, or specialized R&D. These should be in GCCs when the center can provide superior talent density, innovation capacity, or scalability compared to HQ. In this model, the GCC becomes a value creation hub, not just a support center.

- Strategic Capabilities: These are the enterprise crown jewels, including corporate strategy, mergers and acquisitions (M&A), capital allocation, and core brand philosophy. These typically remain anchored at headquarters, where proximity to executive leadership, investors, and regulators is critical.

Risk, IP Sensitivity, and Regulatory Considerations

Beyond strategic fit, leaders must evaluate geographic risk and exposure. Intellectual property sensitivity is a primary filter: functions involving trade secrets or proprietary algorithms may require stronger legal and governance safeguards, or retention at HQ if protections are insufficient. Regulatory constraints such as sovereign data requirements or national security mandates can also dictate a home-country-only model. The objective is to move capabilities closer to global talent pools without introducing unacceptable risk balancing innovation, control, and compliance in a distributed enterprise architecture.

Capabilities That Typically Fit Well in Global Capability Centers

The scope of Global Capability Centers has expanded significantly over the past five years. Once limited to support and operations, GCCs are now becoming central to shaping an enterprise’s technical, digital, and operational future.

Engineering, Digital, Analytics, and Shared Platforms

Modern GCCs increasingly function as digital execution hubs. While corporate headquarters defines strategic direction, GCCs build and scale the underlying technology and operational engines. Software engineering and cloud architecture are well suited to GCCs due to deep pools of STEM talent in global hubs such as Bengaluru, Warsaw, and Mexico City. Advanced analytics and artificial intelligence initiatives are also increasingly GCC-led, as data-driven capabilities are location agnostic and depend primarily on specialized talent. Shared platforms such as global ERP systems and cybersecurity operations benefit from round-the-clock delivery models that GCCs are uniquely positioned to provide.

Global Process Ownership and Automation Programs

A major evolution in the GCC model is the emergence of Global Process Ownership. Historically, headquarters designed processes while delivery centers executed them. Today, GCCs often own processes end to end, acting as centers of excellence for continuous improvement and automation. Functions such as lead-to-cash and record-to-report are increasingly managed from GCCs, where teams drive process redesign, digitization, and robotic process automation. Locating process ownership close to execution reduces feedback delays and enables faster optimization across the enterprise.

Capabilities Better Retained at HQ

Despite the power of the GCC, the HQ still serves a vital, irreplaceable purpose. Certain functions require a level of proximity to shareholders, regulators, and the core identity of the firm that remote centers cannot provide.

Core strategy, investor-facing, and brand-critical roles

Functions that manage the company’s relationship with the outside world and its future direction require the high-context environment of the HQ.

- Investor Relations: The nuances of communicating with the Board of Directors and Wall Street demand a physical presence at the corporate core.

- Corporate Strategy: While a GCC can provide the data for strategy, the final decision-making on pivots, divestitures, and high-stakes partnerships is a Home-Base function.

- Brand Guardianship: High-level creative direction and brand identity are often deeply rooted in the company’s history and culture. While a GCC might execute marketing assets, the global brand voice is typically curated at HQ.

Highly regulated or sovereign activities

Any activity that involves direct interaction with the home country’s government or specific sovereign mandates must remain onshore. This includes government relations, lobbying, and certain high-level legal and tax compliance roles that require deep, localized expertise in the HQ’s domestic jurisdiction.

Building a Dynamic Allocation Model

The biggest mistake an organization can make is treating the HQ-GCC split as a static decision. A capability that belongs at HQ today may be perfect for the GCC in three years.

Review cadence and decision rights

Enterprises should implement a bi-annual capability review. This process assesses the maturity of the GCC. As a center proves its ability to handle complexity, the permission to move more strategic work follows. It must be clear who has the final say in moving a function. This should be a joint decision between the Global Functional Head and the GCC Managing Director, ensuring that the move is driven by value, not just headcount targets.

Evolving scope as the GCC matures

A GCC typically follows a three-stage maturity curve:

- Cost (Years 1-2): Transactional work; focused on arbitrage.

- Talent (Years 3-5): Specialized functions; focused on quality and niche skills.

- Value (Year 5+): Full ownership of global products and strategies.

As the center moves from Stage 1 to Stage 3, the HQ-Only list should naturally shrink. The goal is a fluid organization where work migrates to the location where it can be performed with the highest impact.

The divide between HQ and the GCC is becoming increasingly porous. In the future, the most successful companies won’t be those that protect their HQ turf, but those that treat their GCC as a co-equal partner in value creation. By applying a rigorous, risk-aware, and dynamic allocation framework, leadership can ensure that the distributed brain of the enterprise is firing on all cylinders, regardless of geography.