Global Talent Acquisition Simplified: ANSR’s Employer of Record

Published on

Hiring exceptional talent from around the world has never been easier with the right global recruitment partner by your side. By partnering with an Employer of Record (EOR), you can effortlessly navigate the complexities of cross-border hiring without breaking the bank. Here’s how an employer of record service works.

When a company hires an employee, it becomes responsible for a multitude of duties, expenses, and legal obligations associated with having that employee on board. This can be particularly daunting for multinational corporations with international staff to manage.

What is an employer of record?

An Employer of Record is a specialized third-party organization that takes care of all the legal and operational requirements involved in building a global workforce for its client companies. This includes major EOR services such as managing payroll, taxation, employee benefits, and other administrative and legal obligations associated with employment. With an EOR handling these responsibilities, you can hire top talent from around the world with ease and confidence.

The Functions of an Employer of Record (EOR)

A global Employer of Record (EOR) service provides businesses with the ability to hire professionals worldwide without the need to establish a local entity or worry about breaking regional labor regulations. Essentially, an EOR service acts as a multinational HR company that is knowledgeable about the intricate payroll rules and labor laws of different locations where personnel are located.

The functions of a global EOR include handling regulatory and legal requirements for migration, recruitment, compensation, and perks when a company wants to hire across multiple countries. While the EOR services provider becomes the official and registered employer of the employee, the hiring company retains control over daily management activities such as pay, job responsibilities, projects, and performance evaluations.

A global EOR service can help businesses to:

- Create, record, and update employment contracts that comply with local laws.

- Pay salaries in different countries through their own local bank accounts.

- Oversee all salary and tax deduction records and ensure compliance.

- Pay international employees in their local currency and provide a full range of legal benefits.

- Ensure adherence to all company policies and guidelines.

- Provide updates on local labor laws and regulations to streamline business planning.

- Assist in the integration and employment of new talent with the parent company.

Benefits of engaging an Employer of Record (EOR)

Engaging a worldwide EOR partner offers several advantages for businesses. It allows companies to recruit the best global talent from any location and support them according to their local and cultural requirements. Many businesses lack the resources or in-depth knowledge necessary to legally employ people in international locations, and EORs, with their local presence and expertise, can fill these gaps.

Some benefits of availing Employer of Record services include:

Reduced risk of violating laws: Hiring internationally comes with multiple legal implications that vary from country to country. EORs stay up-to-date with changes in laws related to taxation, employee welfare, and retirement benefits, and provide advice to ensure compliance.

Cost and time effectiveness: Engaging an EOR eliminates the need to set up a legal entity in a foreign country, saving costs associated with registration, bank account opening, and other formalities. Additionally, hiring through an EOR provides access to talent at competitive costs.

Smoother onboarding: EORs ensure smoother onboarding as they are familiar with the cultural, economic, and legal requirements of hiring in the employee’s home country. They handle background verification, documentation, statutory benefits setup, payroll and taxation management, resulting in a smoother overall onboarding experience for both the employee and the employer.

Scalability: Some countries require foreign businesses to form a local corporation for administrative and tax purposes. By serving as the local registered entity, an EOR service eliminates the need to set up a new company, making it easier to scale operations and expand into new markets.

How to Choose the Best Employer of Record (EOR) Services

Choosing the right EOR partner is crucial for achieving hiring and management goals for remote teams. Here are some things to keep in mind:

Transparency: Look for an EOR that is transparent about their costs, including setup costs, taxes, termination fees, and any other potential undisclosed costs or markups that may affect your budget and impact different parts of your company. Ask potential EORs to provide a clear breakdown of all costs upfront.

Track record: Check reviews on independent websites and contact references to determine if current customers are satisfied with the EOR’s services. Ask for references from companies that share similar objectives and traits with your own business, such as budget, sector, employer record and types of employees they work with.

International compliance: Choose an EOR provider with experience in handling EOR work and complying with international requirements, including legal employer burden charges such as medical insurance, social welfare, and paid leave. Ensure that the EOR partner provides accurate quotes for these employer obligations, as they may vary by market.

Accurate quotes: Accurate and transparent quotes are crucial when selecting an Employer of Record (EOR) provider. Look for a knowledgeable and truthful partner who includes all employer burden charges, such as medical insurance, social welfare, and paid leave, when determining payroll expenditures. Your EOR must provide precise pricing on these criteria, as employer regulations vary by market.

It’s important to thoroughly review and understand the costs associated with EOR services before signing any contracts. Any undisclosed fees or expenditures are unacceptable.

Global presence: As global teams are now spread across various talent hubs around the world, your main reason for partnering with an EOR is to access talent in multiple countries. Therefore, it’s imperative to ensure that your EOR has a global presence. You can check the list of 50+ countries where Talent500 can assist you in building your teams here.

Things to keep in mind while choosing EOR solutions

An EOR plays a huge role in the trajectory of a company’s expansion into a new territory, which is why it is imperative that businesses take an informed and reasoned decision when choosing one. The right EOR solution fits in line with the company’s vision, and has the requisite resources to bring it to fruition.

Here are some points that companies should consider in this process:

Established operations in the desired country: The biggest reason for employing global EOR is their grasp of the local laws and experience in operating in a particular country. Every country has its own set of employment legislations, tax regimes, and local operational guidelines. For example, while data privacy laws are not strictly applicable in most South-Asian countries, Europe’s data protection law, GDPR, demands a high level of compliance from all companies operating within the European Union. An EOR that is not locally present in the desired country will be unaware of these requirements, and hence, of little assistance to its clients. Here’s a list of the multiple countries where Talent500 can help companies hire their global EOR teams.

Protection of your IP, data and information security: One of the biggest challenges that companies face when expanding into new territories is the protection of their intellectual property, data and proprietary information. Before choosing an EOR, it is essential to check their policies with respect to data collection, security protocols and mechanisms.

Data privacy & regulation: Before signing up, companies must enquire about the information the EOR is retaining, and how this information is being processed. Companies must insist on utmost information security via ironclad contracts for efficient business management.

Protection of Intellectual Property: A company’s trademark, logo, proprietary technology and all other IPR services is highly valuable, and must be protected when venturing into new markets. Before selecting an EOR, it is crucial to verify that it has the requisite legal framework to be able to protect its client against potential IPR breaches.

Confidential Information: During the course of operations, a company has to share its sensitive information such as customer lists, pricing information & market strategy with its EOR, as well as the subsequent workforce. It falls upon the EOR provider to ensure that this confidential information is protected at all times. This is usually achieved through a dual method – the enforcement of airtight Non Disclosure Agreements with all employees, and the implementation of a robust security mechanism, complete with firewalls and multiple encryptions.

By removing the restrictions of hiring within a 30-mile radius, an Employer of Record enables companies to work with geographically diverse teams, giving them access to a limitless pool of talent. For companies that plan on firmly establishing their base through setting up a subsidiary, availing the services of an EOR is the best way to test the waters in a completely new market with minimal investment. The right EOR solution provides access to the best talent, while simultaneously remaining prudent about the investment of capital and effort.

For in-depth analysis and expert insights on Employer of Record services, visit our Employer of Record Insights page.

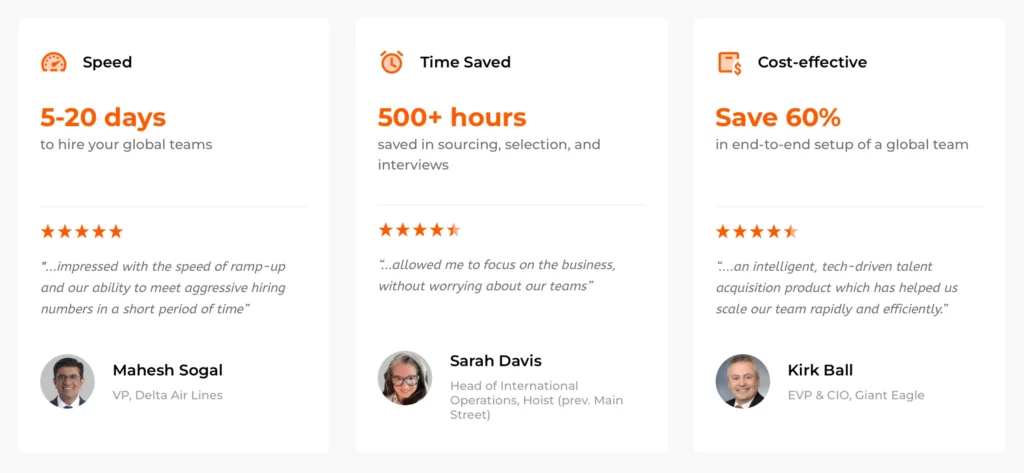

What Our Customers Are Saying