GCCs as Value Drivers in Private Equity

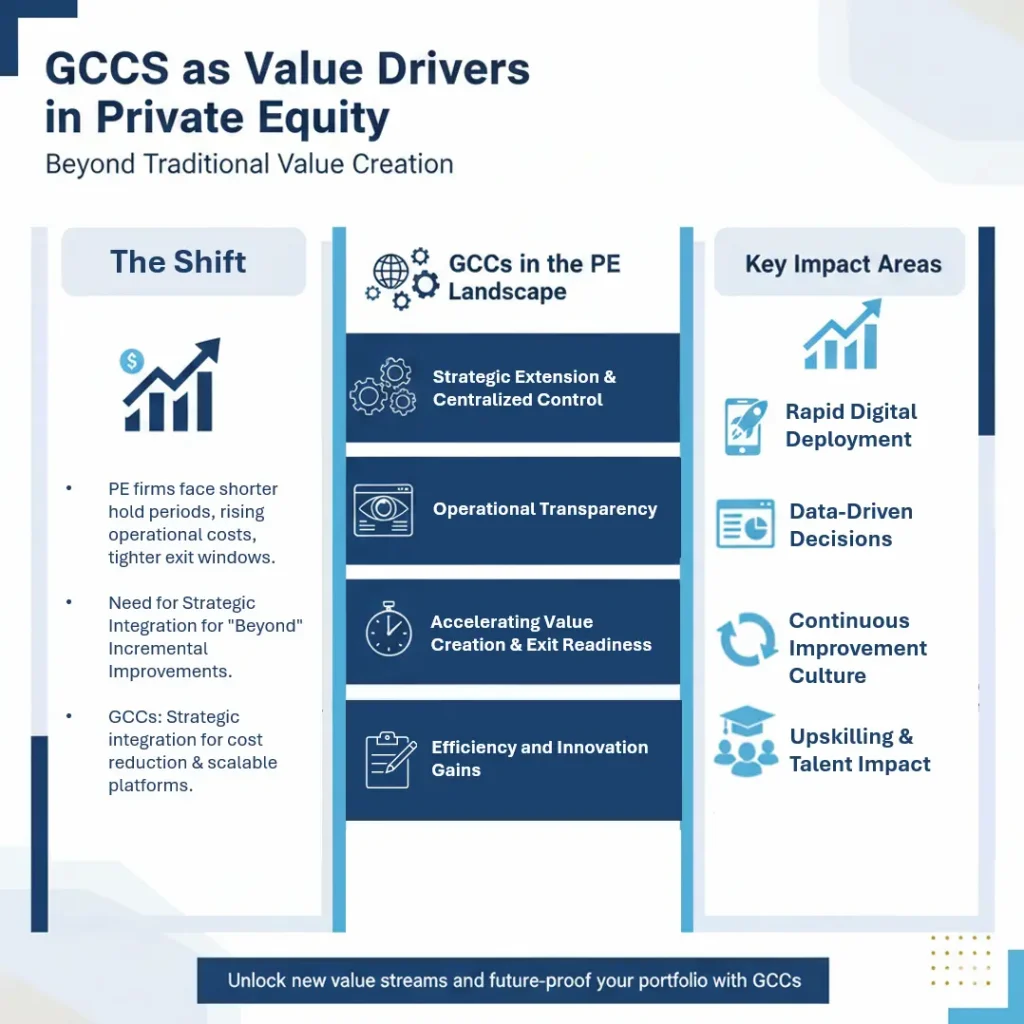

In today’s competitive private equity landscape, traditional value-creation raises pricing optimization, lean operations, and bolt-on acquisitions are no longer sufficient. With shorter hold periods, rising operational costs, and tighter exit windows, PE firms must look beyond incremental improvements.

The strategic integration of GCCs is enabling these firms to aim for cost reduction. They also facilitate building scalable and future-ready platforms for significant PE value creation. This evolved approach focuses on standardizing processes, optimizing operations, and offshoring core functions to geographies with low operational costs and diverse capabilities.

GCCs in the PE Landscape

For Private Equity firms, the Global Capability Center model provides a strategic gateway to cross-functional talent and a unified technology backbone. It drives innovation across the portfolio. More importantly, what sets this model apart is its ability to generate new value streams.

Strategic Extension of Portfolio Operations

GCCs serve as a natural extension of a company’s core. They embed critical capabilities, such as finance, technology, and analytics, into a centralized hub. This supports the day-to-day execution of the acquired business while aligning the center with the parent organization’s goals.

Centralized Control with Scalable Execution

With GCCs, PE firms gain tighter oversight while equipping portfolio companies with the tools and capabilities to scale rapidly. Simultaneously, this facilitates operational efficiency through a GCC across various functions and geographies.

Enhancing Operational Transparency

GCCs also provide real-time transparency and insights by unifying reporting structures, workflows, and technology systems. This makes it easier for the PE firms to monitor performance and progress. Flagging risks at early stages also becomes possible, which ensures consistent execution.

Accelerating Value Creation Timelines

By allowing the quick integration of new acquisitions and scaling up services, GCCs reduce the lag between investment and impact for private equity firms. This helps them deliver on PE value creation plans quickly and more seamlessly.

Supporting Exit Readiness through Process Maturity

Private equity firms now embed GCCs into their value creation strategy, systematically shifting 30-50% of their portfolio talent to global hubs in geographies like India, Mexico, and Eastern Europe. This has a profound impact on exit readiness, delivering a remarkable 4-8X valuation uplift at exit.

Efficiency and Innovation Gains

By leveraging GCCs, portfolio companies can achieve significant operational efficiencies, streamline their workflows, and foster an environment that encourages innovation. These aspects are crucial for enhancing attractiveness for potential buyers.

Process Standardization Across Portfolios

GCCs prove instrumental in delivering consistent and standardized processes across diverse portfolio companies. This translates into a uniformity that supports predictable operations and reduces potential risks associated with future acquisitions.

Cost Optimization Without Compromising Quality

A GCC private equity achieves substantial cost reduction by strategically offshoring core functions to lower-cost regions. These ensure the maintenance and improvement of quality-of-service delivery – a key factor in maximizing valuation.

Rapid Deployment of Digital Solutions

The centralized talent and robust infrastructure of GCCs enable the swift implementation and scaling of digital solutions. This modernizes portfolio companies, making them more competitive and future-proof for exit.

Data-Driven Decision Support

GCCs provide the backbone for collecting, analyzing, and reporting critical business data. This strategy empowers portfolio management with insightful, data-driven decision-making capabilities that prospective buyers highly value.

Fostering a Culture of Continuous Improvement

Beyond immediate gains, GCCs cultivate an organizational culture that focuses on ongoing process optimization and refinement. Building an inducive environment ensures that portfolio companies are equipped for sustained growth post-acquisition.

Upskilling and Talent Impact

For PE firms, the strategic establishment and growth of GCCs represent a significant evolution in talent management. They are emerging as critical drivers of upskilling and talent development, fostering a future-ready workforce within portfolio companies.

By shifting their core functions to GCCs in regions like India, Mexico, and Eastern Europe, PE firms gain access to diverse talent pools from these geographies. This strategy allows them to tap into specialized skills that may not be easily available in the regions where parent organizations are based.

To combat the global skills gap and ensure long-term value creation, GCCs are also actively investing in robust upskilling and reskilling programs. These firms are focusing on formal training, certifications, mentorship programs, and partnerships with academic institutions to ensure that their curricula align with industry demands.

Case Examples

An Ireland-based software consulting and web platform leader set out to establish a mini-Global Capability Center (GCC) in India. However, they faced challenges in securing highly specialized tech talent within aggressive timelines. Building this GCC from the ground up without any existing recruitment infrastructure in place was also a significant challenge.

To overcome these hurdles, they partnered with ANSR, whose recruitment team leveraged the Global Talent Network of 1.6 million skilled professionals. ANSR handled the entire spectrum of workforce management, ensuring a smooth and efficient onboarding experience.

What began with a 11-member team has rapidly evolved into a high-growth India GCC, now set to scale beyond 100 professionals by 2024–25. Through a multi-channel sourcing strategy and smooth candidate engagement, ANSR reduced the hiring turnaround time to just 7 days far outperforming the global average of 4–5 weeks.

At ANSR, our expert teams help private equity firms unlock transformative value by establishing and scaling high-impact Global Capability Centers. From talent strategy and tech enablement to end-to-end operational support, we can help build GCCs that drive real business outcomes faster. Contact our team to discover how ANSR can enhance value creation across your portfolio.