Guide to GCC Impact Metrics: ROI, Innovation, and Strategic Value

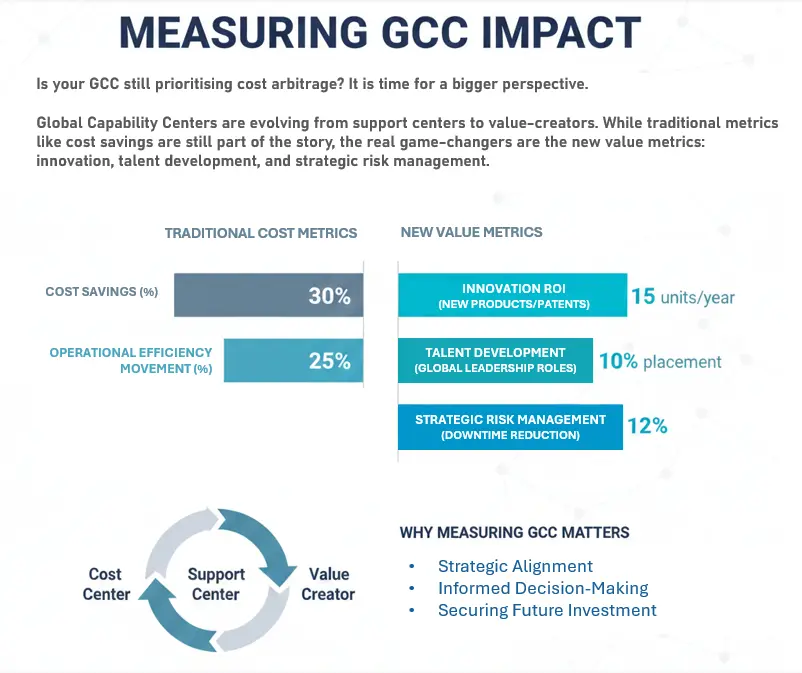

In the last three decades, Global Capability Centers (GCCs) have moved far beyond their conventional purpose of cost savings, and evolved into engines of innovation, strategy and functional leadership. With their evolving nature and functions, the outdated, cost-centric metrics for measuring GCC impact no longer remain viable.

Keeping pace with this evolution means that the methods for measuring success need a complete overhaul. If companies only focus on operational efficiency, they miss out on the bigger picture. Measurement of impact is now shifting toward a GCC’s total contribution.

New metrics take return on investment (ROI) into account. It reflects the innovative solutions GCCs create, the unique capabilities they build, and the value they inject across the entire company.

Why Measuring GCC Impact Matters

Measuring GCC impact is crucial for strategic alignment, as it demonstrates value beyond cost savings. Effective measurement drives informed decision-making and showcases the GCC’s contribution to global organizational goals, which helps secure future investment and resources.

It even allows for better resource allocation by enabling leaders to identify high-performing areas, and areas where improvement is required. Clear value metrics also build trust with stakeholders by providing a transparent view of performance.

Key ROI Metrics for GCCs

Measuring GCC ROI requires a multifaceted approach. To understand its impact in its entirety, enterprises require careful consideration of their day-to-day performance and long-term strategic contributions.

The Financial Picture

Naturally, any evaluation of ROI starts with the numbers. The initial impetus behind the establishment of a center is cost savings. To begin with, parent organizations need to compare the cost of running operations with a GCC with what it would have been back at home. From hiring highly-skilled talent, to the cost of real estate and infrastructure, all these factors can lead to significant cost reduction. Looking further, some GCCs evolve from being cost centers into actual profit centers, generating their own revenue by innovating and offering services to outside clients.

Operational Excellence in Action

A GCC’s success also depends on the quality and efficiency of its work, which is often reflected in the productivity gains. Enterprises can see this in faster transaction processing, higher rates of first-contact resolution for customer issues, and greater output from each employee.

Parent organizations generally utilize Service Level Agreements (SLAs). They act as a formal promise from the GCC to them, highlighting the expected standards of performance. It would be a clear indication of well-run operations if a center consistently achieves or surpasses its targets.

Moreover, GCCs now streamline processes through automation and smarter workflows. This creates tremendous value by eliminating mistakes and speeding everything up.

The Strategic Edge

GCCs even deliver long-term strategic advantages that may not always be easier to quantify and track. One of the key benefits they provide is talent cultivation, which entails opening access to the global pool of highly-skilled professionals.

Measuring GCC impact for this includes tracking employee retention rates and checking how many people from a GCC assumed global leadership roles. This value metric showcases the center’s contribution to building the company’s overall human capital.

As they mature, GCCs transform into hubs for innovation and business transformation. Parent organizations can track the center’s innovation metrics by looking at the number of products or services it has developed. The number of patents filed and how new technologies innovated by them and are adopted across the organization are also certain key performance indicators.

Innovation and Value Metrics Explained

Good metrics allow leaders to track real progress and are essential for modern businesses. This helps to guide strategy and investment.

Intellectual Property and Patents

Intellectual property (IP) is a core business asset which represents the tangible results of innovation. Patents are a key indicator of this, protecting unique inventions from competitors. The number of patents a company files signals a strong focus on research. It also shows a commitment to long-term growth.

Time-to-Market and Agility

The modern market moves incredibly fast, which makes time-to-market a critical metric. It measures the speed of product development. Reducing this timeframe lets companies capture market opportunities first.

On the other hand, agility is the ability to adapt to change. Agile companies respond quickly to new information and can pivot their focus without losing momentum.

Moving Beyond Cost Savings: Strategic Value of GCCs

Success needs to be quantified in new ways that reflect a GCC’s evolving role. GCCs now tackle complex global objectives and develop robust, innovative ecosystems that create intellectual property and new digital products. Therefore, measuring the holistic impact of a GCC is critical.

This includes tracking strategic alignment, innovation ROI, and contributions to the talent pipeline. To fully realize their potential, GCCs need a new, more comprehensive understanding of the value they create.

Accurately measuring GCC impact is vital for recognizing its full strategic worth. The new metrics seek to quantify contributions made towards innovation, talent development, and overall business value. Ready to redefine your GCC’s success? Contact ANSR today to unlock your GCC’s true potential.