Offshoring vs GCC Models

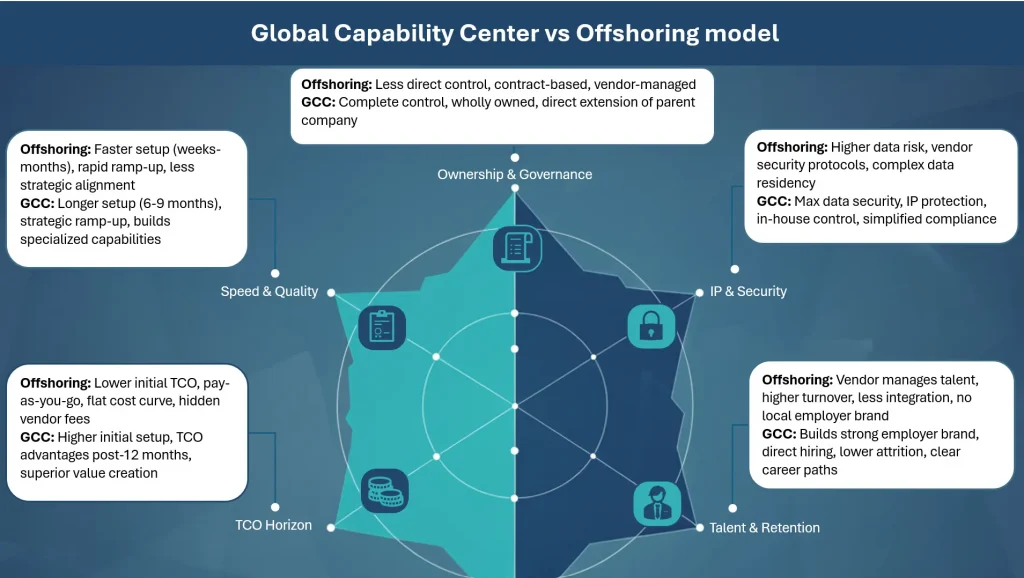

Offshoring and Global Capability Centers (GCCs) are both master plans used by multinational corporations to grasp a global talent pool and for cost arbitrage. However, modern enterprises are increasingly differentiating between these two models to achieve distinct business objectives.

While traditional offshoring often serves as a cost-saving tactic by delegating non-core tasks to a third-party vendor, the GCC model has evolved into a long-term strategic asset, acting as a wholly owned innovation and growth engine for the parent company.

Ownership and Governance

Understanding how ownership and governance differ is critical when evaluating global talent models. The level of control you possess can significantly alter the center’s role, impact, and long-term value.

Offshoring vs. GCC Control

Offshoring: It relies on third-party providers, giving the parent company less direct control. Governance is contract-based, and the vendor manages the team and day-to-day operations. This can be advantageous for well-defined, non-critical tasks.

GCC: The parent company owns and operates the entire center, ensuring complete control over processes, talent management, and operational strategy. This model identifies the offshore entity as a direct extension of the parent company, allowing for greater integration and strategic alignment.

IP and Security

When sensitive data and proprietary knowledge is involved, the choice of a model has far-reaching consequences. How and where your data is stored and who is responsible for it can directly impact compliance, risk exposure, and long-term IP security.

Data Residency Responsibilities

Offshoring: A higher risk for data security and intellectual property (IP) protection is required, as sensitive information is shared with an external vendor. The vendor’s security protocols and compliance regulations determine the protection level. Data residency and sovereignty can be more difficult to manage, as the data is not entirely located within the company’s own infrastructure.

GCC: Ensures maximum data security and IP protection because the data remains in the parent company’s direct control and IT infrastructure. This approach simplifies compliance with global data privacy regulations such as GDPR, as data residency can be fully managed in-house.

Speed and Quality

Balancing speed with long-term value is a key consideration when choosing your operating model. The right approach depends on whether rapid deployment or building sustainable, high-quality capabilities is the greater priority.

Setup Time vs. Ramp-up

Offshoring: A traditional outsourcing setup is significantly faster, taking weeks to a few months. This allows for a rapid ramp-up of services, but the speed can come at the cost of deep strategic alignment and knowledge transfer.

GCC: The setup time is considerably longer, often taking 6–9 months, due to the need for infrastructure, legal entity establishment, and direct hiring. While the initial setup is slower, the subsequent ramp-up is more strategic and focused on building internal, specialized capabilities.

Talent and Retention

Talent is the backbone of any global operation, and how you attract and retain it differs greatly by model. Your choice directly influences employer brand strength, workforce loyalty, and the depth of expertise you can build over time.

Employer Brand Dynamics

Offshoring: The external provider manages talent, which can lead to higher turnover rates and less integration with the parent company’s culture. The company does not build its employer brand in the local market, making it harder to attract high-value talent long-term.

GCC: Enables the parent company to build a strong employer brand in the offshore location, directly hiring, training, and retaining a dedicated workforce. This allows for the creation of a cohesive company culture and lowers attrition rates by providing clear career paths and greater employee loyalty. High-performing professionals in key markets often prefer to work for GCCs over traditional service providers.

Total Cost of Ownership

Cost considerations evolve, and the total cost of ownership (TCO) curve is crucial for long-term planning. The ideal model depends on whether short-term savings or sustained value creation is the primary objective.

12–36 Month Curves

Offshoring: The TCO is initially lower due to minimal upfront investment and a pay-as-you-go model. The cost curve is relatively flat or has a predictable increase in contract renewals. Hidden costs such as vendor margins, additional statutory benefits, quality issues, and communication overhead can accumulate over time.

GCC: The TCO curve is inverted, with higher infrastructure and setup costs. As the unit stabilizes after approximately 12 months, the cumulative cost advantages and efficiencies begin to show. In the next 2–3 years, a GCC can provide superior TCO compared to offshoring, eliminating vendor profit margins and capturing greater value from in-house innovation and efficiency.

In the end, the choice between offshoring and a GCC comes down to your organization’s long-term vision, whether seeking quick wins through cost savings or aim to build a strategic, innovation-led engine that drives sustained growth.

Ready to explore how a GCC can transform your global strategy? Partner with ANSR to build and scale your own GCC or Offshore center with confidence.