What is a Legal Entity? Everything You Need to Know

In today’s interconnected business landscape, establishing a formal legal entity is essential to ensure operational security, efficiency, and compliance. A legal entity provides the framework that governs how organizations operate, engage with markets, and safeguard the interests of stakeholders.

Having a clear legal status helps businesses of all sizes grow, take risks, and build trust. As of today, there are about 358.7 million businesses in the world, clearly demonstrating the importance of setting up a distinct legal entity. Interestingly, about 90% of businesses in the world are small and medium-sized enterprises (SMEs). This underscores the pivotal role of legal entities in fostering entrepreneurship, driving job creation, and fueling innovation across economies.

What is a Legal Entity: Definition and Meaning

A legal entity is a formally recognized structure, distinct from its owners, with its own rights and obligations. It can own assets, enter into contracts, conduct business independently, and be held accountable under the law.

This concept is fundamental to modern commerce, as it enables individuals and organizations to operate businesses without intermingling personal and corporate liabilities.

Its key characteristics include:

- Independent existence from its owners

- Ability to own, buy, or sell property

- Power to enter into contracts and conduct transactions

- Capacity to sue or be sued as a separate party

- Continuity despite ownership or management changes

- Limited liability protection for owners

- Compliance with regulatory and legal obligations

- Recognition for taxation as a distinct entity

- Ability to raise funds or capital under its own name

- Distinct identity with a registered name and official records

Choosing the right legal entity is not only about understanding these characteristics but also about aligning them with business goals. Different structures carry varying implications for taxation, liability, compliance, and growth opportunities. Therefore, organizations need to evaluate several factors before deciding which legal entity best suits their operations, including:

- Long-term scalability and alignment with growth objectives

- Level of liability protection for owners and stakeholders

- Tax obligations and potential impact on profitability

- Administrative complexity and regulatory requirements

- Ease of transferring ownership or succession planning

- Access to outside funding and investment opportunities

- Flexibility in management and decision-making processes

- Industry-specific legal and compliance considerations

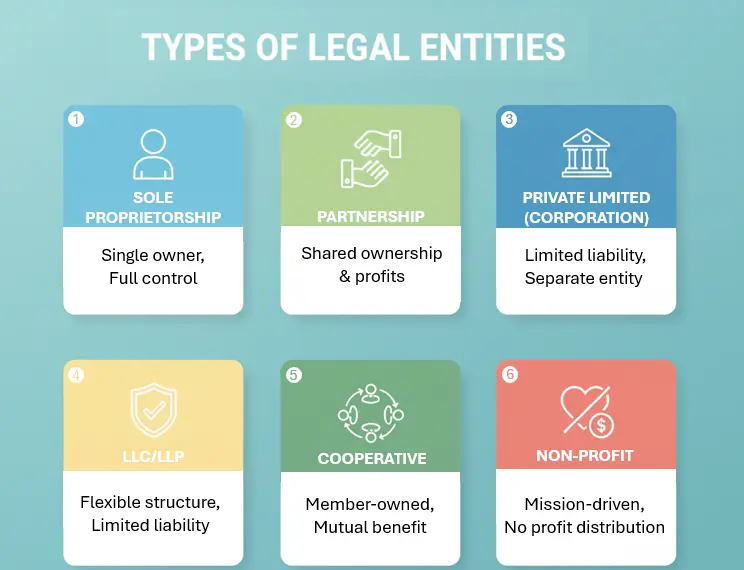

Types of Legal Entities in Business

When starting or running a business, choosing the right legal structure becomes a fundamental step. Different entities come with unique rules, responsibilities, and advantages, particularly in areas such as taxation, liability, and governance.

Understanding these differences allows organizations to align their structure with long-term goals. The table below highlights the main types of legal entities.

Type of Legal Entity | Description | Key Features | Examples |

Sole Proprietorship | Owned and managed by a single individual |

|

|

Partnership | Business run by two or more individuals |

|

|

Corporation (Private Limited) | A separate legal entity from its owners |

|

|

Limited Liability Company/Limited Liability Partnership (LLC/LLP) | Hybrid of corporation and partnership |

| Small to mid-sized businesses |

Cooperative | Owned and operated by a group for mutual benefit |

|

|

Nonprofit Organization | Operates for social, charitable, or educational purposes |

|

|

Why Choose the Right Legal Business Entity?

Choosing the right legal business structure is one of the most important things any company can do. The choice has an impact on taxes, liability, compliance, and even the ability to get investors. A structure that fits well not only protects assets but also sets the business up for growth and long-term stability.

Its key reasons include:

- Protecting personal assets from business liabilities

- Determining how profits and losses are taxed

- Influencing credibility with investors and partners

- Defining ownership and decision-making powers

- Impacting regulatory requirements and paperwork

- Supporting scalability and future expansion plans

- Affecting the ease of raising funds or capital

- Shaping succession planning and transfer of ownership

- Determining eligibility for government contracts or benefits

- Setting the level of privacy and disclosure requirements

Choosing the right legal entity is a strategic choice that affects taxes, liability, compliance, and long-term growth. Many companies succeed by aligning their entity structure with their growth plans.

When a top global consumer health company worked with ANSR to set up its GCC in India, the right entity setup made it easy to enter the market and ensured that legal compliance was a focus area right from the start. Such decisions made by entities can directly affect how well they work and how big they can get.

Collaborate with ANSR to ensure that your firm’s entity structuring for a GCC or CoE in India is clear and accurate. Schedule a meeting with our team to see how we can help you build your entity on a solid foundation and position it for long-term success.